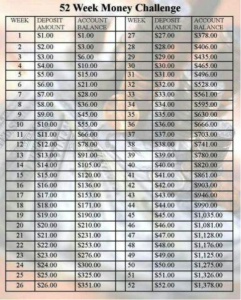

As a Finance major, volunteer, and intern at Financial Beginnings I frequently teach the subject of Banking and often the fact that I have no savings account comes up in class. I have been making excuses for myself to explain this and I would say to the students “Oh I used to have one, but now I’m in college full time and can’t maintain the minimum balance”. So I have decided that 2014 is a new year for me and I need to start following my own advice. I got the idea to start saving again while browsing the subject of “Finance” on Pinterest. I came across “The 52 Week Money Challenge” and all you have to do is save the dollar amount of the week you’re in for the year. For example in week 1 you would put away $1 and in the last week of the year you would put away $52. At the end of the year you should have saved $1,378.The first two weeks were so easy to save for, but then it started getting more difficult. I learned in Personal Finance (taught by Melody Bell) that the hardest thing about using your money wisely is actually doing it, and I am discovering how true that is. Since I still do not have a savings account, I have to withdraw the cash I save from my checking account and ended up getting behind. However, in week 5 of The 52 Week Money Challenge, I am actually ahead of the game. Instead of having the planned $15 saved for week 5, I am already up to $23. I look forward to saving even more and I intend to stay ahead of the savings plan from now on.

Adrienne Prevost